Get the free insurance endorsement

Show details

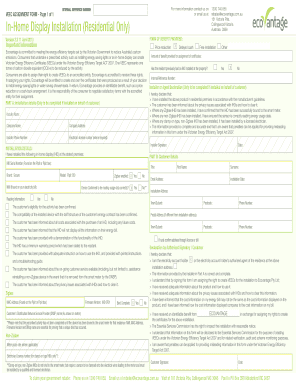

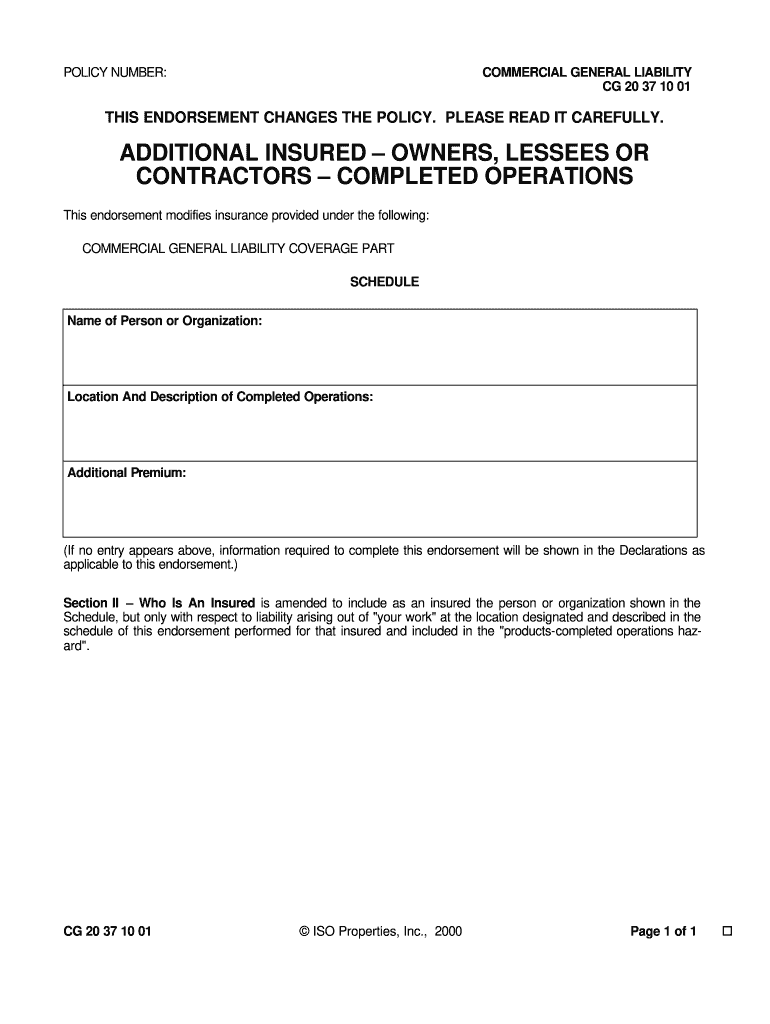

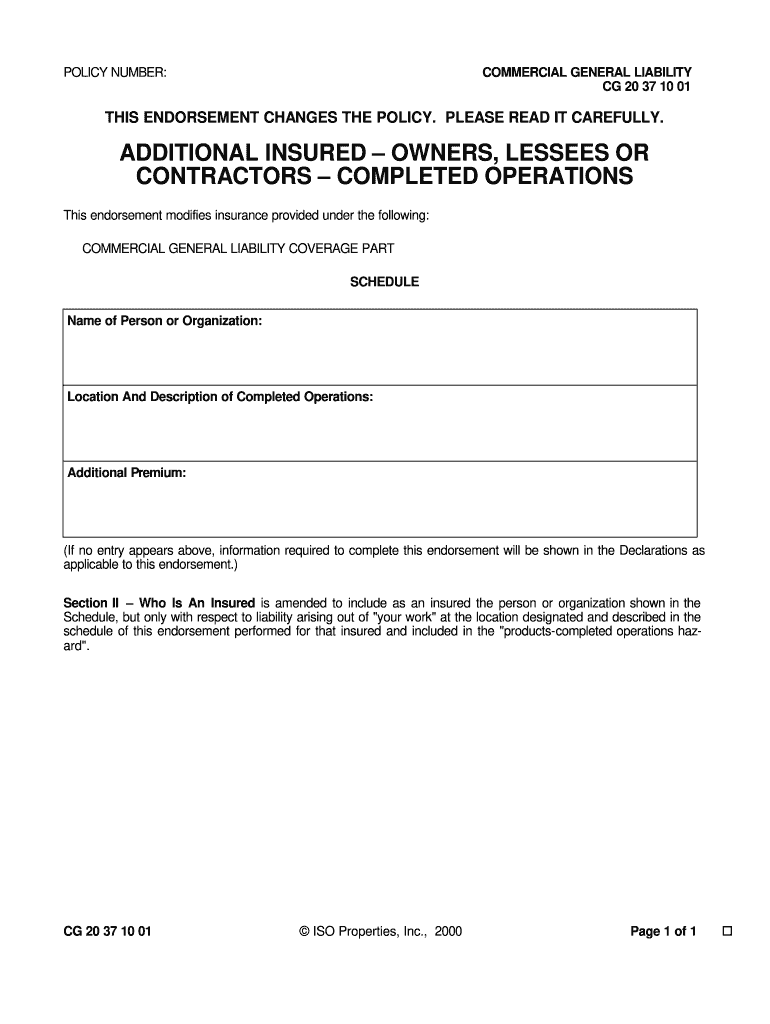

This document is an endorsement to the Commercial General Liability insurance policy that modifies coverage to include specific additional insured parties with respect to completed operations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general liability form

Edit your endorsement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your additional insured endorsement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit endorsement page insurance online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit endorsement examples form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out examples of endorsement in insurance form

How to fill out insurance endorsement page:

01

Obtain the endorsement page from your insurance provider. Usually, this can be requested by contacting your insurance agent or through your insurance company's website.

02

Read the instructions carefully. Make sure to understand the purpose of the endorsement page and what changes it allows you to make to your existing insurance policy.

03

Identify the specific changes you want to make to your policy. This could include adding or removing coverage, updating your personal information, or modifying policy limits.

04

Fill out the required fields on the endorsement page. This may include providing your name, policy number, effective date, and any other relevant information requested.

05

Clearly and accurately document the changes you are requesting. Use clear and concise language to describe the updates you want to make to your policy.

06

Review the information you have provided. Double-check for any errors or missing information before submitting the endorsement page to your insurance provider.

07

Submit the completed endorsement page to your insurance company. You may need to mail it, fax it, or upload it through their online portal. Follow the instructions provided by your insurance provider to ensure a smooth submission process.

08

Keep a copy of the completed endorsement page for your records. This will serve as proof of the changes you requested and can be useful for future reference or if any discrepancies arise.

Who needs insurance endorsement page:

01

Policyholders who want to make changes to their existing insurance policy.

02

Individuals or businesses that require modifications to their coverage, such as adding or removing specific protections.

03

People who have experienced a change in circumstances that may affect their insurance needs, such as a change in vehicle ownership, acquiring or selling property, or starting a new business venture.

Fill

insurance endorsement page

: Try Risk Free

People Also Ask about insurance endorsement sample

What is a insurance endorsement?

An insurance endorsement/rider is an amendment to an existing insurance contract that changes the terms of the original policy. An endorsement/rider can be issued at the time of purchase, mid-term or at renewal time. Insurance premiums may be affected and adjusted as a result.

What is an endorsement page for insurance?

An insurance endorsement/rider is an amendment to an existing insurance contract that changes the terms of the original policy. An endorsement/rider can be issued at the time of purchase, mid-term or at renewal time.

What is an example of an insurance endorsement?

A common endorsement is scheduled personal property coverage, which you can buy as extra coverage for specific types of belongings. For example, you might have an insurance endorsement to add coverage for a valuable piece of jewelry, like an engagement ring, or expensive artwork.

What is an example of an endorsement?

A signature is an endorsement. For example, when an employer issues a payroll check, it authorizes or endorses the transfer of money from the business account to the employee. The act of signing the check is considered an endorsement, which serves as proof of the payer's intent to transfer funds to the payee.

What are the most common endorsements?

Below are some of the most popular policy add-ons: Identity theft coverage. Home business coverage. Dwelling under construction coverage. Sinkhole coverage. Windstorm coverage. Earthquake coverage. Loss assessment coverage. Ordinance or law coverage.

How do I get an endorsement on my car insurance?

A policyholder can request the endorsements by connecting with their insurer's customer care team and submitting the required documents to substantiate those changes. However, the insurer will only make the necessary changes after checking the authenticity of the submitted documents.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send additional insured endorsement sample to be eSigned by others?

insurance endorsement example is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I edit endorsement form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share insurance endorsement form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out endorsement insurance example on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your blank endorsement. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is insurance endorsement sample?

An insurance endorsement sample is a document that modifies the terms of an existing insurance policy. It can add, remove, or change coverage, limits, or exclusions.

Who is required to file insurance endorsement sample?

Typically, the policyholder or the insurance agent is required to file an insurance endorsement sample when modifications to the policy are necessary.

How to fill out insurance endorsement sample?

To fill out an insurance endorsement sample, the policyholder needs to provide details such as the policy number, the specific changes being requested, and any additional information required by the insurer.

What is the purpose of insurance endorsement sample?

The purpose of an insurance endorsement sample is to formally document changes to an insurance policy, ensuring that both the insurer and policyholder are aware of the adjustments and that the policy accurately reflects the current coverage.

What information must be reported on insurance endorsement sample?

The information that must be reported on an insurance endorsement sample typically includes the policyholder's name, policy number, details of the changes being made, effective date of the endorsement, and signatures if required.

Fill out your insurance endorsement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Additional Insured Endorsement Example is not the form you're looking for?Search for another form here.

Keywords relevant to endorsement forms

Related to blank endorsement example

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.